7 Best Payroll Services for Small Businesses

While payday is a welcome event for employees, for managers, the payroll calculation process can be a daunting task. Small and medium-sized businesses must stay on top of payroll processing, as even a minor miscalculation can throw off accounting records and trigger fines from tax authorities.

Fortunately, various services for calculating the best payroll for small business take on all complex calculations and ensure timely payment. Typically, for a company with five employees, such services typically cost less than $100 per month, making them a cost-effective solution.

Timely and accurate payroll processing is a cornerstone of successful business operations. To help you navigate the options, we’ve analyzed online payroll services for small businesses. So get ready to jot down the payroll providers for small businesses we’ve tested so that you can choose one that fits your needs best.

What Is a Payroll Company?

A payroll company is a service provider that takes care of employee payments. It performs salary calculations, tax withholdings and ensures compliance with legal requirements. The best payroll companies facilitate accurate and timely payroll processing, simplify obligations management, and allow business owners to focus on core operations without getting bogged down in administrative tasks.

Top Payroll Services for Small Businesses

Here is a quick rundown of seven top payroll companies that made it to our list of best payroll providers. We’ll walk you through their key features, unique advantages, and pricing so you can find the best fit for your business. Explore these top-rated payroll services.

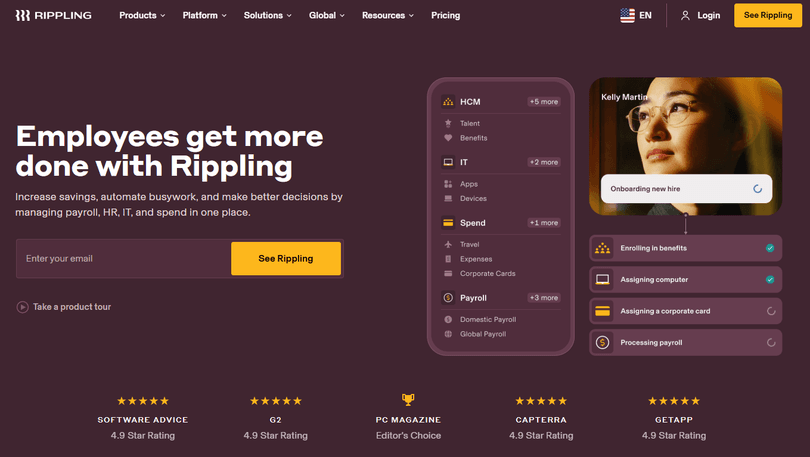

Rippling

The best payroll solution with integrated HR and IT management. A free demo is available. Pricing starts at $35 per month + $8 per user. It’s suitable for businesses of all sizes.

Key Features:

- Global payroll processing: Quick and seamless payments for employees and contractors worldwide.

- Automated tax filing: The system calculates, files, and pays tax payments automatically.

- Robust integrations: Works with Google Workspace, Microsoft 365, Slack, QuickBooks, Salesforce, and more.

Advantages:

- Supports international payments.

- Manages company devices alongside payroll processing.

- Combines HR, IT, and financial functions in one platform.

With Rippling, businesses can merge payroll management with HR functions, such as benefits administration and compliance tracking. It also enables managing IT tasks, including device setup and access to apps. This simplifies workflows and reduces the need for multiple systems.

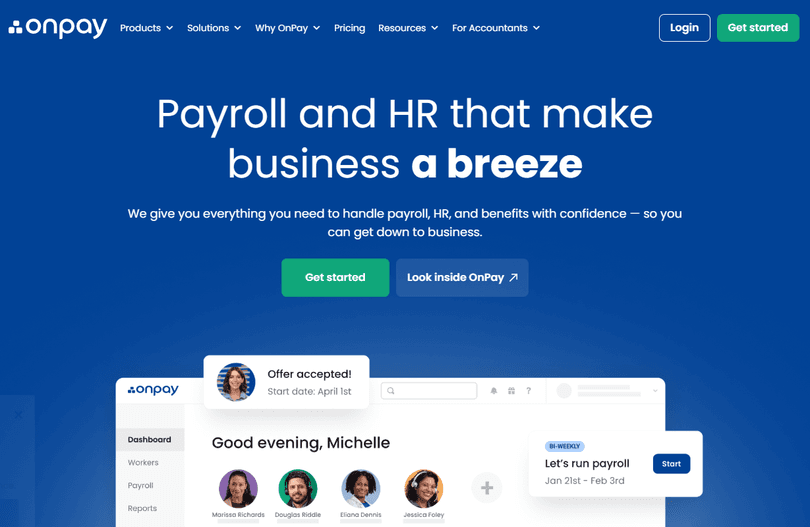

OnPay

A payroll service designed for industry-specific needs and in-house insurance brokers. A 30-day free trial is available. Pricing starts at $6 per user/month.

Key Features:

- Built-in HR tools, tax accounting, and insurance services.

- Full-service payroll tailored for small and medium-sized businesses.

- Automated tax reporting and payment handling.

Advantages:

- Integrated HR and compliance management tools.

- Customizable payroll settings for different industries.

- Option to connect insurance services.

OnPay is an excellent choice for businesses needing industry-specific payroll processing and benefits management.

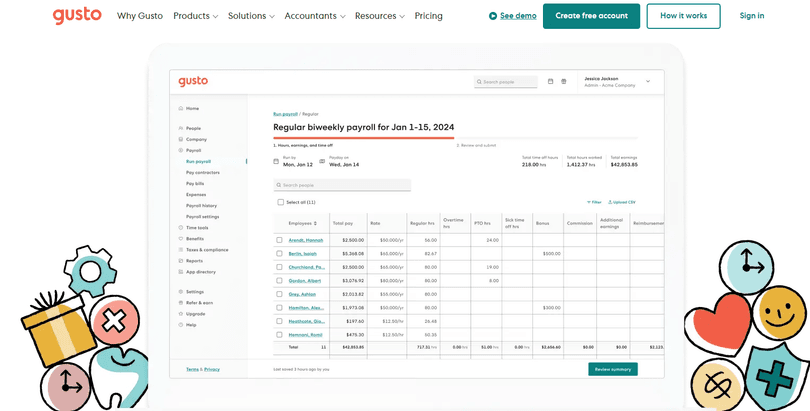

Gusto

Gusto is the ideal solution for small businesses and beginners in payroll processing. Pricing starts at $40/month + $6/month per employee.

Key Features:

- Simple and automated payroll processing.

- Built-in HR tools and benefits administration.

- Automated tax filing and reporting.

Advantages:

- Option only for contractors.

- User-friendly interface.

- Unlimited payroll runs.

Gusto is a great pick for small business owners seeking an intuitive payroll service with automated payments, tax calculations, and leave management.

Justworks

Justworks is a Professional Employer Organization (PEO) that is designed for remote teams. It handles a portion of the employer's legal obligations, allowing businesses to stay focused on core operations. You delegate control over some essential functions, such as paying salaries. Pricing starts at $59 per employee/month or $49 per employee/month for companies with more than 50 employees.

Key Features:

- Payroll and tax processing.

- Vendor and contractor payments.

- Time tracking and attendance management.

- HR consulting services.

Advantages:

- Reduces administrative workload on HR teams.

- User-friendly self-service portal for employees.

- The PEO collaboration model helps minimize employer risks.

Justworks earns positive reviews for its ease of use and ability to scale with growing businesses.

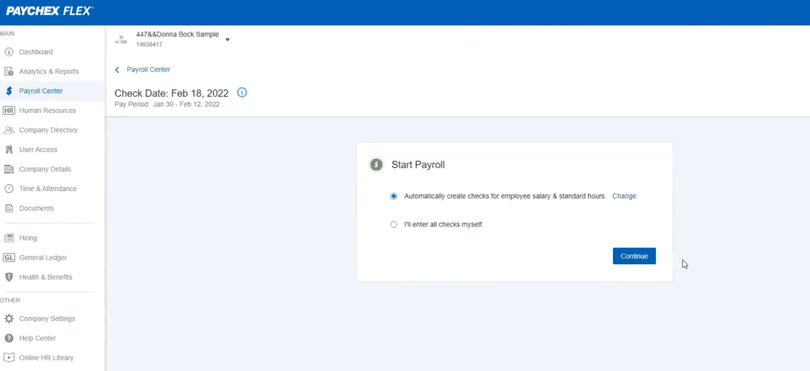

Paychex Flex

Paychex Flex provides a comprehensive payroll, HR service, and benefits administration services tailored to the needs of businesses of all sizes — from solo entrepreneurs to large corporations. A free demo version is available, with pricing upon request.

Key Features:

- Tax reporting and payroll processing.

- Customizable payroll features.

- Time-tracking system with employee hours integrated directly into payroll.

- API support for tailored integrations.

Advantages:

- Intuitive mobile app for payroll management.

- 24/7 customer support.

Paychex Flex is particularly well-suited payroll company with enhanced support for U.S. businesses in healthcare, retail, construction, education, and manufacturing.

ADP RUN

It is designed for companies with fewer than 50 employees. Attention to detail makes ADP RUN a trusted payroll solution for organizations requiring in-depth accounting, payroll processing, and reporting capabilities. Since ADP offers plans for businesses of all sizes, it is an attractive option for companies planning to grow. Pricing starts at $79 per month plus $4 per employee.

Key Features:

- Comprehensive employee record management.

- Extensive reporting capabilities.

- Full-service HR toolkit.

Benefits:

- Simple and user-friendly interface.

- Excellent mobile apps.

ADP is a well-established provider of payroll and benefits administration services. ADP RUN is its version for small and medium-sized businesses with a powerful yet flexible payroll solution.

TriNet

This is the best PEO service tailored for industry-specific needs. Pricing starts at $16 per employee per month.

Key Features:

- Software for online payroll processing, automatic payments, leave tracking, and expense management.

- Employee health insurance and wellness support programs.

- A wide range of standard reports on staff, payments, and payroll.

- Minimum five employees required to use the service.

Advantages:

- Quick implementation process — setup usually takes about two weeks.

- Easy-to-use TriNet platform interface with clear navigation.

- Straightforward access settings.

TriNet is a strong choice for businesses needing industry-specific HR support and payroll solutions for teams ranging from 5 to 250 employees.

How Do We Estimate Payroll Services?

Each year, we analyze and check payroll services to help you choose the best solution for your business.

We focus on platforms that best serve small businesses processing payroll for 10 or fewer employees. During testing, we use real-world payroll data to assess accuracy, reliability, and ease of use. Additionally, we evaluate the company's reputation, security measures, and customer support.

Conclusion

Selecting the best payroll services can help small businesses streamline payments, simplify tax management, and improve workforce administration. We’ve reviewed the top payroll providers to help you find the best fit for your business.

Using a payroll service over manual processing offers greater accuracy, ensures compliance, and significantly reduces administrative burden. It significantly saves time, eliminates unnecessary stress, and provides easy access to all current and archived payroll records. By choosing the best payroll solution for your business, you can cut down on paperwork, avoid costly errors, and focus on what truly matters — growing your company.