Conventional Loans: What They Are and How They Work

Contents

Despite rising real estate prices, the number of Americans owning a private home seems to still increase over time, reaching 66% of the population by 2024. One possible explanation for this paradox is the good range of loans currently available on the market.

Individuals with a good credit rating and stable income can use conventional loans without resorting to alternative financing methods. But what is a conventional loan, and how does it differ from other loan types? If you want to learn more about conventional loans, including how to qualify for them, keep reading!

What’s a Conventional Loan?

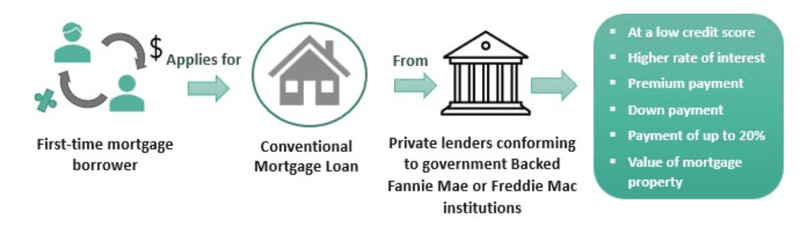

A conventional loan is a mortgage that isn't backed by a government entity like the Federal Housing Administration, the Department of Veterans Affairs, or the Department of Agriculture loan initiatives. Instead, it is provided by private lenders like credit unions or banks.

How does a conventional loan work? First of all, an applicant requests a certain sum of money from a lender. To qualify, borrowers usually need to have a high credit score, a stable income, and a down payment (at least 3–20%). Private mortgage insurance is frequently required for loans with a down payment of less than 20%.

Conventional loans bear fixed or adjustable interest rates and are regulated by Fannie Mae and Freddie Mac guidelines. They are designed for individuals with a high credit rating and earnings who want more loan-term options than government-backed products can provide.

Understanding Conventional Loan Requirements

The eligibility requirements differ by lender but are usually stricter than those of government-supported loan programs. Here’s a list of the common eligibility criteria you can expect:

Good Credit Score

Normally, getting approved for a conventional loan requires a credit score of at least 620. Better terms and lower interest rates are available to borrowers with higher ratings, such as those of 740 or higher.

Conventional Mortgage Down Payment

A conventional loan usually includes a down payment of 20% of the real estate property's acquisition price, but there are also options for lower payments. You may need to make a larger down payment if you have a low credit score or a high debt-to-income ratio.

Debt-to-Income Ratio

To qualify, borrowers must have a DTI of 36% or less, with housing expenditures accounting for 28% to 35% of the total. If you’re lucky, you may find a lender who approves applicants with DTIs of as high as 43%, but they are few and far between.

Your DTI is calculated by dividing your monthly income before taxes by the total of your current monthly debts, such as rent or car loan payments. To assess your chances, use a debt-to-income calculator.

Limits

Your borrowing maximum depends on whether you select a conforming or non-conforming loan.

Conforming loan maximums vary by location. In 2025, the average maximum is $806,500. However, the limit is considerably higher in high-cost areas, reaching up to $1,209,750. The limits for non-conforming loans are set by the lenders and are far harder to predict.

Proof of Employment and Income

Borrowers are required to provide proof of stable employment and consistent income to the lender. Those with a stable income and long employment history are less prone to defaulting on their debts and so usually have a higher chance of approval.

Luckily, HomeReady and Home Possible programs provide options for low- to moderate-income applicants. How much down payment for a conventional loan will be in this case? Both programs require a minimum 3% deposit, which is rather low by industry standards.

Conventional Loan Types

There are several options you can go for when applying for a conventional loan, meaning you’re more likely to find a product to suit you.

Conforming Loans

They follow regulations set by Freddie Mac and Fannie Mae, which set limits and borrower eligibility requirements. Currently, the conforming loan limit for one-unit mortgages is $806,500. They usually have lower interest rates and better terms because they are standardized.

Non-Conforming Loans

Non-conforming loans don’t adhere to Fannie Mae and Freddie Mac guidelines. They include jumbo loans with larger limits and the ones designed to provide financing for specific financial needs. Because they carry more risk for lenders, non-conforming loans usually have stricter approval criteria as well as higher interest rates.

Portfolio Loans

These loans offer more flexible qualification criteria (for example, lower down payments), but usually have higher interest rates. Such loans are not sold on the secondary market and instead stay in the lender’s portfolio, which means stricter repayment terms.

Fixed-Rate Loans

This loan class offers stability for the entire repayment period because the interest rate remains unchanged. Fixed-rate financing is a perfect choice for borrowers who value predictability and can afford to pay for it.

Adjustable-Rate Mortgages (ARMs)

These loans offer a lower initial interest rate than their fixed counterparts. However, in this case, the rate can change during the entire period of credit validity. This may still be beneficial for a borrower who plans to refinance or sell the house before the end of the loan’s introductory period. However, handling this loan class takes good risk-management skills, as monthly payments may increase, making budgeting difficult.

Remember that a mortgage lending specialist can help you find a conventional loan that meets your financial situation and goals.

Weighing the Advantages and Disadvantages of Conventional Loans

Now we’re done discussing the conventional mortgage definition, we can assess its pros and cons.

Advantages

- Competitive interest rates. Government-sponsored financing typically has higher interest rates than a conventional loan, meaning you can save quite a lot over the life of your mortgage.

- Lower advance payments. Some conventional loans require down payments as low as 3%, which makes homeownership accessible to a broad range of borrowers. However, if you want to avoid paying for private mortgage insurance, you’ll still have to make an initial deposit of at least 20%.

- Variety of credit products. Conventional loans are available in various formats, including fixed and variable interest rates (ARMs). This variety allows borrowers to choose a product that better fits their financial goals and risk tolerance.

- Possibility of refinancing. Conventional loans do not have restrictions on refinancing, giving borrowers more flexibility and allowing them to get better terms.

- Option to exit PMI. With conventional loans, a borrower can cancel PMI upon reaching 80% LTV (loan-to-value ratio), thus reducing their monthly payments.

Conventional loans allow the borrower to build equity by owning a home from the start. However, like any other credit type, they have certain disadvantages.

Disadvantages

- Stricter credit score requirements. As a rule, getting a conventional loan requires a higher credit rating (over 620) and a better debt-to-income ratio than when dealing with FHA loans.

- Higher interest rates. Conventional loans have a little higher rates compared to FHA or VA loans. The difference may seem small, but it can add up quickly over the life of your mortgage. For example, if you take a loan with an interest rate of 5% instead of FHA’s 4.5%, you will end up paying a few thousand dollars more.

- Additional commissions. The commissions usually apply only to certain types of real estate (manufactured or second homes, condos, etc.) and non-owner borrowers, as lenders consider these to be riskier investments.

Note that not all conventional loans have all the listed disadvantages. Some lenders offer more flexible terms, while market conditions affect availability and pricing.

Final Thought

So, now you know not just the conventional loan definition but also the eligibility requirements, types, advantages, and disadvantages of this loan class. It is a valuable tool for borrowers with strong credit and stable income because it offers more options and flexible terms. Also, you won't have to pay PMI if you can make a 20%+ down payment. However, if your down payment is smaller or you have a low credit score, you may want to explore government-backed financing options.