Net Present Value (NPV): What It Is and How to Calculate It

Contents

Imagine you have two investment opportunities in front of you. One promises steady returns over the next five years, while the other offers a large payout in the future. How do you determine which one is better? That is where the Net Present Value (NPV) comes in.

Below, we’ll break down the net present value meaning, why this financial tool is so essential, and how to calculate NPV.

What Is NPV in Finance?

A simple NPV definition is that it is a financial metric used by businesses and investors to evaluate the profitability of an investment or project by answering a key question, “How much is future money worth today?” Since the value of money changes over time due to inflation, opportunity cost, and risk, a dollar today is not the same as a dollar even a year from now. A dollar today is worth more than a dollar in the future. This is because money today can be invested, earn interest, or generate more income. Built on this concept, an NPV helps determine whether an investment you’re thinking about creates value or destroys it by comparing its initial cost with the present value of future returns.

What does NPV mean in finance on a broader scale, though? Unlike simple profit calculations, NPV incorporates the time value of money to ensure that future earnings reflect their true worth today. It levels the playing field by converting future cash flows into present-day values, allowing for a direct, apples-to-apples comparison of investment opportunities. So, a project may appear profitable on the surface, but once future cash flows are adjusted for risk and the time value of money, it may lose value. By using NPV, businesses can avoid bad investments that look attractive but do not actually generate actual financial benefits.

As such, NPV is a fundamental tool in capital budgeting. Large corporations, investors, and financial analysts routinely use it to evaluate mergers, acquisitions, new product launches, and infrastructure projects.

How Is NPV Calculated?

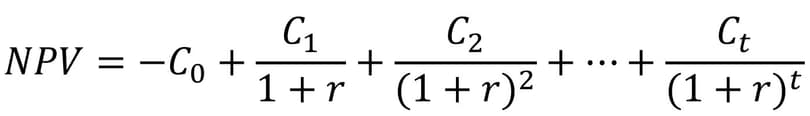

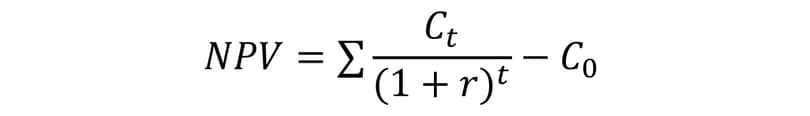

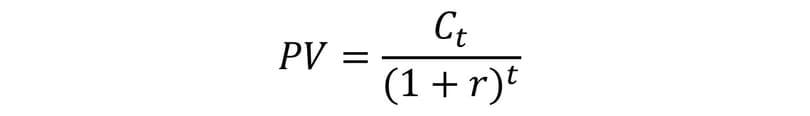

To apply NPV in real-world scenarios and make smarter financial decisions, you must understand how to calculate NPV properly. Yet, before diving into the step-by-step process, let’s look at the basic formula:

or

Where:

Ct = Cash flow in year t;

r = Discount rate (required rate of return or cost of capital);

t = The number of periods (in years or months) i.e., the investment duration;

C0 = Initial investment (cash outflow at year 0).

In essence, NPV calculates the total worth of all future cash flows in today’s dollars, then deducts the initial investment, revealing the true profitability of an opportunity.

Now, let’s break down the net present value calculation steps in more detail.

1. Identify the Cash Flows

You should list all the expected cash flows related to the investment, including:

- The initial investment (usually a negative cash flow).

- The anticipated cash inflows for each year of the project.

Example: A company considering investing $100,000 in a promising project, expecting these cash inflows over four years:

- Year 1: $30,000;

- Year 2: $40,000;

- Year 3: $35,000;

- Year 4: $25,000.

2. Determine the Discount Rate

The discount rate represents the return required for the investment to be worthwhile. For example, if you expect to earn 8% annually from alternative investments (such as stocks or bonds), any new project must at least match or exceed that figure to be considered worthwhile.

Choosing the right discount rate is no cookie-cutter decision. Companies and investors tailor their approach based on the investment type, whether it’s the cost of capital, the required rate of return, or the company’s weighted average cost of capital (WACC). The choice can make or break the profitability equation.

For our project, let’s assume the discount rate is 10% (0.10 in decimal form).

3. Discount Future Cash Flows for Their Present Value

Now, we apply the present value calculation to each period’s cash flow:

and receive the following results:

- Year 1: 27,272;

- Year 2: 33,058;

- Year 3: 26,282;

- Year 4: 17,072.

Each cash flow must be discounted using the correct time period t don’t accidentally discount all cash flows using the same factor. For our project, t = 1,2,3,4 for the years 1,2,3,4, respectively.

4. Sum Up the Present Values of Future Cash Flows

Now, we sum up all the above discounted cash flows:

27,272 + 33,058 + 26,282 + 17,072 =103,684

5. Subtract the Initial Investment

Finally, we subtract the initial investment ($100,000) from the total present value of future cash flows:

103,684–100,000 = 3,684

6. Interpret the Result

Since the NPV is positive ($3,684), this project is expected to generate more value than it costs. A negative NPV would indicate that the project destroys value, making it an unattractive investment. If NPV=0, the investment would break even (no gain, no loss).

NPV Benefits and Downsides

Like all financial metrics, NPV isn’t perfect. It has its strengths but also some limitations. Whether you’re an investor, a business owner, or a student learning finance, understanding the pros and cons of this financial tool will help you see the bigger picture.

Pros | Cons |

|---|---|

|

|

NPV Pluses

- Accounts for the time value of money: A dollar today is worth more than a dollar tomorrow because money can be invested and earn interest over time. NPV takes this into account, ensuring that we’re comparing all values in today’s dollars when considering an investment.

- Provides a clear profitability indicator: Giving a straightforward answer (positive or negative NPV), NPV makes it easy to make go or no-go decisions. You don’t have to guess whether the project will generate enough return, it’s all in the numbers.

- Incorporates risk and cost of capital: The discount rate required in the NPV formula often reflects the investment risk. If an investment is riskier, a higher discount rate is used. So, NPV also accounts for the uncertainty of future returns.

- Works across industries: Unlike some financial metrics that only work for certain industries, NPV is versatile. It can be used in corporate finance, real estate, personal finance, stock investments, etc.

NPV Minuses

- Relies on an accurate discount rate: Choosing the right discount rate is tricky. Miscalculating this metric can make or break an investment decision. If you set it too high, NPV might undervalue the investment. And with a rate that is too low, NPV might overestimate the project’s profitability.

- Requires precise future cash flow estimates: Predicting the future is hard, let’s face it. If your cash flow estimates are wrong, your NPV will be misleading, either overestimating or underestimating the project’s true value.

- Ignores non-financial factors: Not everything in business is about numbers. Sometimes, strategic investments with a negative NPV may still be worth pursuing. For example, a company expanding into a new market might initially lose money but win long-term market dominance.

Final Thoughts

Now that you know the NPV meaning and the math behind its calculation, we can confidently state that NPV is a decision-making powerhouse, providing a quite realistic estimate of whether the investment will truly create value. However, to make well-rounded investment choices, NPV should be applied alongside other methods and metrics such as the Internal Rate of Return (IRR), Payback Period, Profitability Index, and Scenario Analysis.