How to Void a Check: Explained and Tips

Do you know how to void a check? There are quite a few reasons you might want to render a check unusable without physically destroying it. For instance, a check includes banking information you might want to use as proof of transaction or when setting up automatic payments.

In other words, voiding a check is a must when you must use one but need to protect sensitive personal data. In this guide, we will discuss all the steps to cancel checks and provide some additional check-related security tips.

What Is a Voided Check?

In short, a voided check is a standard check that can’t be used normally (and usually has the word “VOID” written on it). This is an official way to cancel a check accepted by all financial institutions nationwide. All you need to do is write the word “VOID” over the text in the center, so your banking information remains visible.

While a voided check is no longer valid for withdrawing money, it is still used in a few situations. For instance, you may use it when making an ACH transfer, setting up a direct deposit, and enabling different automatic payments. You can also use a voided check to share your account information.

Steps to Correctly Void a Check

Whether you are looking for a voided check example for direct deposit or you need it for another procedure, you are in luck! Voiding a check is one of the most straightforward procedures in banking.

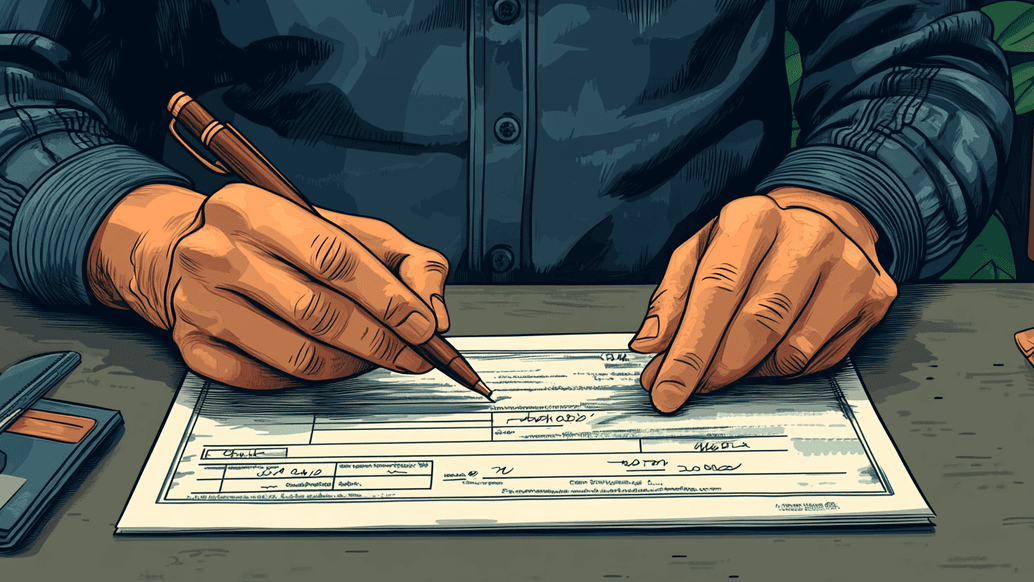

Here are the steps you’ll need to take:

- Use a pen in saturated colors. The black and blue are the most common options.

- Next, write “VOID” in big letters right on the check. While there’s technically no guide on where to write “VOID” on a check, and you can, say write it in smaller letters on any of the check’s lines, we advise against this to avoid ambiguity.

- If you plan using duplicate voided checks, you’ll need to make sure that your writing is visible on the copy.

- It is also a good idea to keep a record of the voided check or make a copy of it. Depending on your preferences, you can do this in your management software or your check register. Make sure to write down both the date and the check number, so there’s no confusion later on.

Top Tips for Voiding a Check

Here are some additional tips to prevent any possible check-related security risks:

- Always destroy your voided checks

While a canceled check becomes unusable, it still contains your financial data, such as the bank routing number and your account number. So, when you no longer need the check, you should take your time to shred it or otherwise make your data unintelligible.

- Make sure your writing is clear

When writing “VOID,” avoid using a pen in colors other than blue or black, as they are not as visible, particularly on duplicates. Make sure you use a permanent pen and not an erasable one. Also, don’t write the word partially or make it too small.

- Don’t give a blank check to people you don’t trust

Even if it may seem that giving a voided check to a stranger won’t do any harm, it is best not to do so for security reasons. It is advisable to treat your checks the way you would your bank cards or cash.

Common Reasons to Void a Check

Now that we’ve discussed how to void a blank check the right way, let’s talk about some cases when you may need to do so. The most common ones include:

- Making a mistake

If you made a mistake when writing a check, it is best to void it so that you don’t proceed with it by accident. Note that you can do this only if you still have the check. Otherwise, you will have to ask your bank to cancel the payment.

- Direct deposits

To ensure correct electronic banking transactions, you may need to provide your employer with a voided check. This is one of the easiest ways to give them your account number.

- Electronic payments

Another reason to void a check is if you plan to use one to schedule an electronic financial transaction. Whether you own a business or need to make personal payments, a void check can be a useful instrument.

- Bill payments

To schedule recurring payments from your account, you’ll need to first learn how to send a void check.

- Bank details verification

Another example of when you might need a voided check is when you lease an apartment. By providing a voided check, you prove that you have an active bank account without having to perform any transactions. This is usually both safer and more convenient.

Final Thought

Voided checks are useful in several financial situations. By simply writing the word “VOID” on your check, you can make sure that it cannot be used by third parties to withdraw money from your account. And that’s void check meaning for you!

The primary way you can use a canceled check is to verify account information. Also, it’s advisable to do so if you’ve made a mistake when writing a check, just in case. Just keep in mind that you should destroy your voided checks once you don’t need them anymore.